CONSUMER

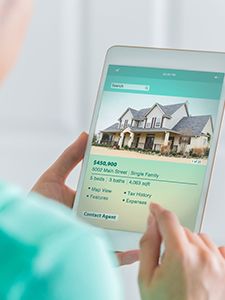

PURCHASE

RESOURCES

WHOLESALE

- BROKER

- SELECT PARTNER

-

LOAN PRODUCTS

-

ALL IN ONE LOAN

- CONTACT

CORRESPONDENT

-

LOAN PRODUCTS

-

ALL IN ONE LOAN

-

CONTACT

ABOUT CMG